SGF "Citizens" Commission on Community Investment

The Marxists vs. Metrocrats FIGHT Over Renewed 3/4-Cent Sales Tax in Springfield.

From Whom ALL Blessings Flow

City comprehensive plans have become Government infused byproducts of UN Agenda 21 - Sustainable Development. For why, check out my last article. For how, I’ll refer you to my next one. But in short, UNA21 is a global comprehensive plan implemented at the local level. It’s commonly known as, “smart growth.”

US Citizens have been separated protected on multiple layers from having any input in how federal money is actually spent at the local level. Much like the Soviets, our spoils system flows from the vastly overgrown tentacle of the executive branch, through a complex syndicate of unelected councils, ultimately arriving where we ain’t.

When federal funds find their way into tax exempt coffers, a FOIA no-go zone, we lose oversight altogether. Norman Dodd was acutely aware of this, and it’s one of many reasons resuming the Reece Committee, or starting one at the local/state level could pay quick dividends!

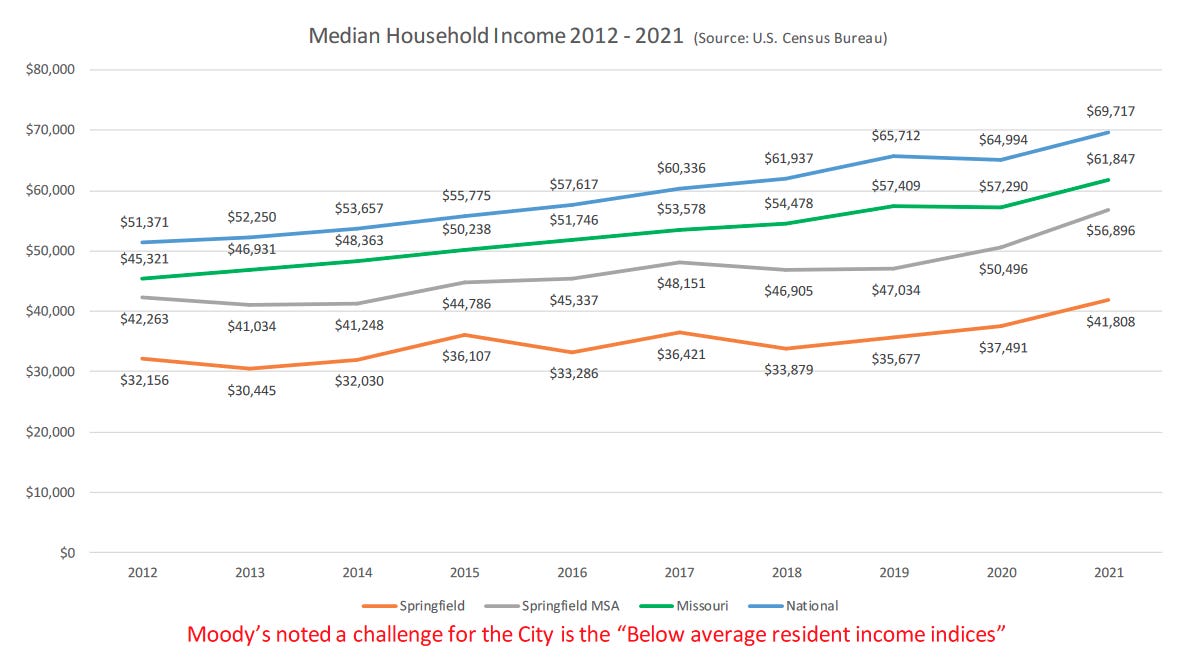

Inflation is a tax on the future cost of goods and services and the bears have come home to den in Springfield. Once renown for affordable housing, SGF has become a 60% renter occupied suitcase city. As small towns crumble, the City is making economic development deals with partners from larger metros with the aim of growing the tax base through workforce development. However, the wealth seems to settle and accumulate down at the Chamber.

The Springfield Police Officers & Firefighters Retirement System (SPOFRS)

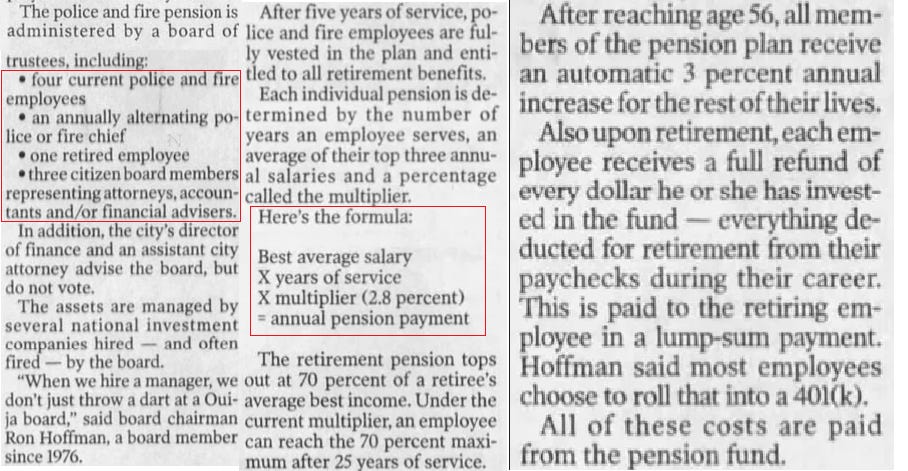

The last time they came to us with hat in hand, it was over this same thing. The Springfield Police Officers & Firefighters Retirement System (SPOFRS) was created in 1946 as an independent pension fund.

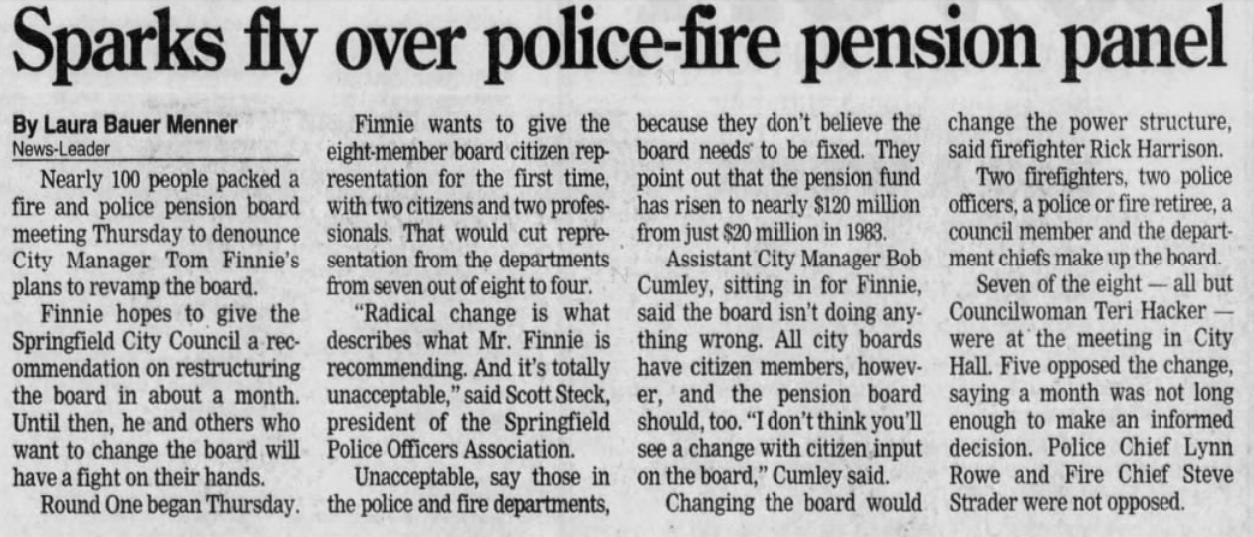

Going through the archives, seems this particular fund had given the city troubles since the turn of the century, when the pension fund board was pressured to take on “citizen” members. Ultimately it took on three.

The dot com bubble crashed in 2001. Assets were used to cover pension payments instead of profits. Alarms started ringing in 2005, because cops and firefighters were living longer than they used to, and also retiring younger. At that point the funding ratio (total employees supported) was resting at 55%. The desired rate was somewhere between 75%-85%.

Springfield had a revenue increase in 2005-06 of $3.5 million. But $2 million went to pay increases, and after budget priorities and new equipment there was nothing left. They struggled back and forth over tweaking the existing plan and taking on more risk or switching new hires over to the state system (LAGERS). They ultimately went with LAGERS. This was controversial as it affected new recruiting and obviously morale for those born too late to reap the rewards of the independent plan.

But that independent plan (SPOFRS) was still there as 2008 rolled in more financial pain. While millions of Americans were losing their houses and jobs because of recklessness in the sub-prime mortgage derivatives markets, the fund sank hundreds of millions of dollars in arrears. It was then decided that a group of ordinary, every day citizens (wealthy types) should come together towards the solution.

The answer, of course, was to take it out of the people of Springfield’s pockets. And so they did, to the tune of 3/4-cent per dollar spent in Springfield for 16 years until the fund ballooned from 38% to 90% in 2024. That tax is scheduled to sunset by summer of next year. Instead of a parade of gratitude…

A proposed 3/4-cent tax will likely be on the ballot in November, 2/3rds of which will create an open ended funding stream for Forward SGF, the city’s comprehensive plan nobody voted on. Less than 10% of the population provided input and even that was of the multiple choice variety.

Most of it was engineered outside of Springfield by metrocratic Chicago firms who copy/pasted it from model statues in a 1400 page, tax-payer funded book authored by the American Planning Association called, “Growing Smart - A Legislative Guidebook.”

A mere 1/4-cent of this tax will go to shore up retirement for 100 brave public servants with some left over for staying competitive on salary. The lion’s share will be a “fluffer” tax to supplement the rivers of cash pouring in from the fed towards the twenty year “smart growth” project. Although the tax will sunset in 10 years, they will then likely ask for a full 1 to 2-cent booster for even more ambitious projects.

You’re drowning in inflation, contemplating a smaller, more affordable living situation. Retirement doesn’t seem realistic. They’re living in sprawl, scheming up ways for you to foot the bill to lay down the hardscape of your future poverty. People. Place. Prosperity.

Language is important. They wouldn’t spend so much time and money crafting slogans and terminology if it was insignificant. The city cannot repeat enough how much it engages with you. It’s how they sneak things by you without a vote!

None of us buy it. But that does not matter, because if a few carefully selected people show up, then they can say there was buy-in. Here’s the pitch:

key parts in bold.

“Shall the City of Springfield, Missouri enact a city sales tax at the rate of three-quarters of one percent (3/4-cent), one-quarter for the purpose of funding public safety initiatives, to include funding the remaining obligation of the Springfield Police Officers’ and Firefighters’ Pension and increasing police officer and firefighter pay, with said one-quarter to not sunset, and two-quarters for the purpose of funding projects consistent with the City’s comprehensive plan, to include capital improvements, community and neighborhood initiatives, and park projects, with said two-quarters to sunset after a period of ten years? (Note: there will be no increase in the current sales tax level if the 3/4-cent sales tax is approved.)”

"There will be no increase in the current sales tax level.” A fine way to state, “there would be a decrease in the current sales tax level.” Oddly, none of the stakeholders on the commission suggested this.

The inflation that they’re largely responsible for creating has been affecting them also. Employee retention is difficult and it’s hard to keep talent with these metrocrats shifting around the metroplex like free agents in the major leagues.

The commission reinforced that presenting two separate bills on a fractional penny tax is a non-starter. It was not discussed where they will find the money to meet the pension obligation should Springfieldians choose not to fund Forward SGF for the next 10 years, at least without housing as a priority. Our small brains cannot handle the option to select the priority tax over a very nice-to-have for The City™.

I wasn’t expecting this kind of dishonesty from an entity that prides itself so much on engagement. We should probably start engaging with each other on a few things now and just leave “The City™” out altogether. At least until they find it within themselves to muster a proper thank you.

I’ve been watching the replays of the commission and still wondering what the purpose was? There was not a single opponent of taxation in the entire crowd. Once again, the Delphi technique has been deployed to manufacture consensus.

Going down the list it’s a member of council, chamber, chair, executive, president, developer, consultant, etc… I don’t see a lot of people on this list who would not somehow be a stakeholder.

From the news-leader:

You can find materials shared on the CCCI here @ the city website.

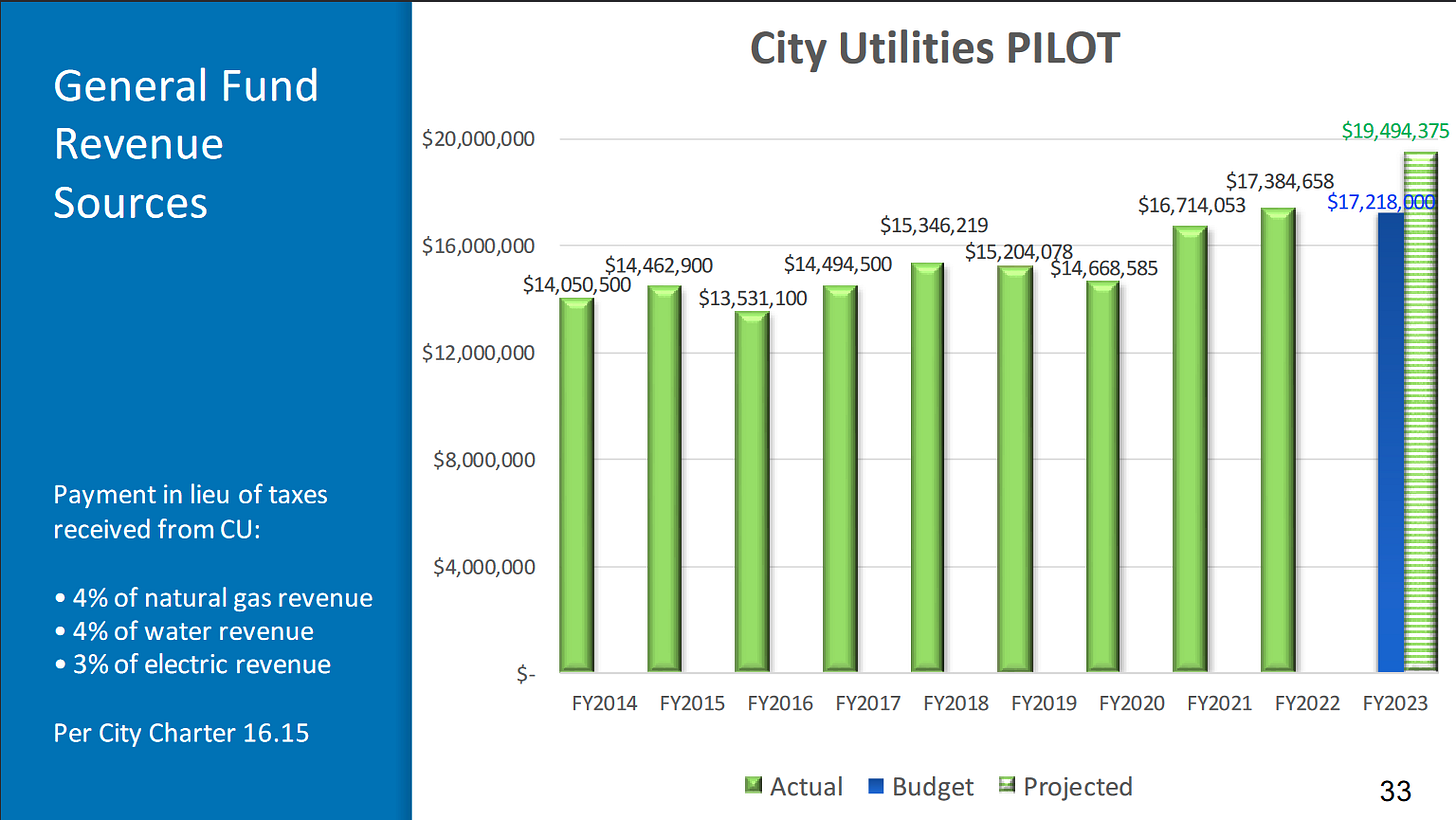

You might ask, “Why can’t they find this in the general fund or the use tax?” That would be a great question! Well, the general fund is tapped because 2/3rds of the income growth goes mostly towards employee retention. Pay Plan Improvements (PPI) is a term the city has used since the 70’s, when the CDBG’s were rolling out, to keep up with the inflation caused by all that grant money they took. 👉👈

But if federal aid is the cause of inflation, the city should not be squeezing us turnips to cover up their sweet tooth for free money. They should be pressuring the regional banks, state/federal government, councils and foundations from which this money came for sustainable economic reforms. Now that would be smart growth!

I won’t get into the shady origins of the Federal Reserve banking system right now, or how even though it’s intent was to secure us from panic and corruption with elasticity and uncontrolled credits, it has done neither for over a century.

The New Deal (planning) was the Government’s solution to the abject failure of the Federal Reserve banking system to insulate us from panic. And we all know how Springfield welcomed that great project.

When all the councils of government organized during Nixon and Ford, Springfield said dump the loot right here on the front lawn. And so on through the Federal Reserve’s other failures until ARPA, the most recent cash injection.

Even if it just went to the unions and they got to pick the winners, we’d do better than what we have now.

On the other hand, the city boasts about their ability to bring in grant money to solve every problem. It’s never solved a single problem, nor will it ever. It’s rife with corruption and they never share. Doesn’t sound like the city grant machine is slowing down either…

City council adopted the commission’s language at a meeting on July 8. SDC Government reporter, Jack McGee quoted councilman Matt Simpson at the meeting:

Councilmember Matthew Simpson, who served as a City Council liaison on the commission, commended the commission’s recommendations, suggesting that the tax measure “may be the most important thing that any of us work on.”

“For a unanimous recommendation to occur with as difficult as these questions were and as diverse a group and thought that we had, I think it’s a real impressive testament to your all’s work and the commission’s work,” Simpson said. “And I think that’s reflected in the result.”

“Diverse.” That would be funny if it weren’t so misleading.

In the same article, co-chair Tom Prater is quoted saying, “Great cities are intentional, and we’re trying to be intentional about what we do here. We can muddle along and be mediocre, but I think Springfield’s better than that.

By intentional, I can only assume he means centrally planned. Muddling along means giving you anything other than multiple choice suggestions in the design and direction. A city that centralizes all planning is a city under central planning. The train is headed east and I don’t think you union types are getting a ticket.

Marxists in City Hall

Springfield City Council held a public hearing on July 22 and while there was nobody speaking against the tax, members of STUN, Springfield’s local tenant’s union, came out in force to plead for specific language in the bill granting a soft commitment for code enforcement and affordable housing.

Alice Barber, closest thing to a civilian on the commission, reminded council that although the villagers are not ready (yet) with torches and pitchforks, they have grown enough in numbers to make up a healthy sized voting bloc.

But it wasn’t just STUN in attendance. There were other members of the community, of the organized variety. Dr. Derosset of Drury University and Missouri Jobs With Justice made a compelling argument regarding challenges faced in his duties at the Springfield Land Trust ⚒️ which would benefit from a tax revenue stream.

Councilman Hosmer asked Derosset to expand on the costs of living associated with damaged or under-insulated homes.

Springfield public housing authority was well represented with both Katie Anderson and Isabell Jimenez Walker taking the microphone. Mrs Anderson mentioned the waiting list for section 8 housing within the city alone (3,500). The proposed solution from the council of course was to ask how we could get a hold of more grants and vouchers.

Isabell Jimenez Walker asked for both funding for housing and support for code enforcement in the BDS Department which is once again searching for a director. The third one to abruptly leave in five years.

By far the best address was given by Andrea Palamar of zone 4. It was only two minutes, but I’m sure to a few of the council-folk, it felt longer:

After the public hearing, Jenson introduced an amendment to include housing to the bill, Horton seconded the motion. Although the debate was heated, none of it was about whether or not you should be able to keep your damn money.